The Role of Technology in NSE Option Chain Trading

The role of technology in NSE (National Stock Exchange) Option Chain trading has undergone a transformative evolution, significantly impacting the way investors and traders engage with financial markets. The advent of advanced technologies, particularly automation and algorithmic trading, has brought efficiency, speed, and precision to the complex landscape of options trading.

Automation in NSE Option Chain trading involves the use of computer programs and algorithms to execute trades, monitor markets, and manage portfolios. One of the key advantages of automation is the ability to execute trades at high speeds, ensuring that orders are placed and executed in fractions of a second. This is crucial in options trading, where market conditions can change rapidly, and timely execution is paramount. Check what is demat?

Algorithmic trading, a subset of automated trading, involves the use of algorithms to analyse market data, identify trading opportunities, and execute orders. In the context of option chain trading, algorithms can be designed to exploit specific patterns, pricing differentials, or volatility movements. These algorithms can execute complex options strategies with precision and efficiency, allowing traders to capitalise on market opportunities more effectively.

Risk management is another area where technology plays a crucial role in NSE Option Chain trading. Automated systems can incorporate risk parameters and execute predefined risk management strategies automatically. This includes setting stop-loss orders, adjusting position sizes based on market conditions, and implementing hedging strategies to protect portfolios from adverse market movements.Check what is demat?

The use of technology in NSE Option Chain trading extends to sophisticated modelling and analytics. Traders can leverage advanced mathematical models to assess option pricing, implied volatility, and potential profit and loss scenarios. These models can process vast amounts of data and perform complex calculations in real-time, providing traders with insights that would be challenging to obtain through manual analysis.

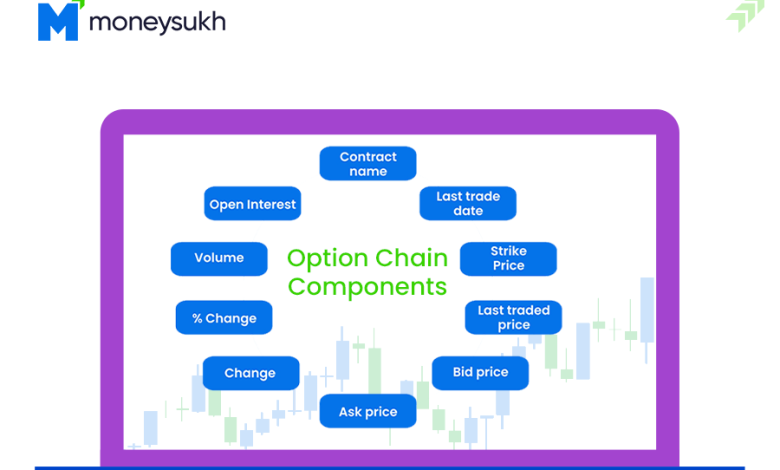

Trading platforms equipped with advanced features have become integral to option chain trading. These platforms offer real-time data, customizable charting tools, and options analytics that empower traders to make informed decisions. The integration of technology enables traders to visualise option chains, analyse historical data, and execute trades seamlessly, enhancing the overall efficiency of the trading process. Check what is demat?

Machine learning and artificial intelligence (AI) are making significant contributions to NSE Option Chain trading. These technologies can analyse vast datasets, identify patterns, and adapt trading strategies based on evolving market conditions. Machine learning algorithms can continuously learn and improve, helping traders stay ahead of the curve in a dynamic market environment.

The rise of application programming interfaces (APIs) has facilitated connectivity between trading platforms, enabling seamless integration with external tools and systems. Traders can develop custom applications, automate trade executions, and access a wide range of financial data through APIs. This connectivity enhances flexibility and allows for a more personalised and efficient trading experience. Check what is demat?

While technology brings numerous advantages to NSE Option Chain trading, it also introduces new challenges, particularly related to cybersecurity and market integrity. The reliance on electronic systems makes trading platforms susceptible to cyber threats, and regulators are continually adapting to ensure the security and stability of financial markets.